When Push comes to Shove

Most people don't realise that the value of their "paper" wealth (i.e. dollars, pounds, shares, bonds, derivatives, ETFs, etc) is based only on hope and promises. The investments themselves have no material value - they are just paper with ink on them. You hope someone else will deliver some greater future value to you when you want it, probably in cash.

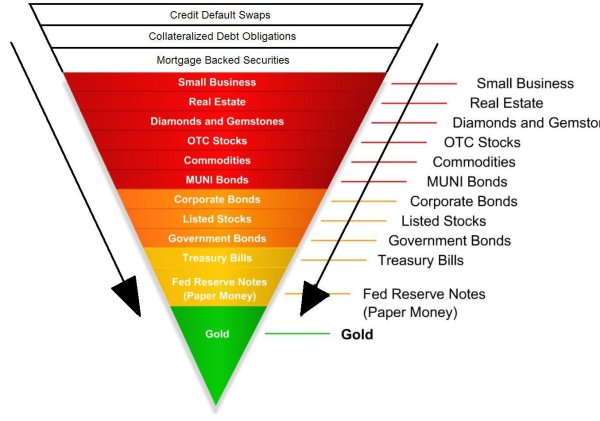

There is a heirarchy of investments, a ladder from the more solid to the more speculative: as you go up the ladder, the financial strength of each rung is based on the perceived strength of the rung below.

Exter's Pyramid (click image to enlarge)

When the most complex and most widespread investment class fails (i.e. derivatives - the blue slice at the top of the picture), all these battered investors scramble down the ladder to lodge any surviving wealth "safely" on lower rungs (e.g the red or the orange slices), which massively increases the demand upon these "safer", less complex investments and their prices rise sharply. Of course, if the supply of these lower level products is overwhelmed by this desperate rush of capital, and greedy brokers take liberties along the way, these investments may well collapse in their turn and so the capital cascades down to flood the levels even further below.

The Tower of Jenga - What goes up must come down (click image to enlarge)

Can you see that the whole inverted pyramid of value in the so-called sophisticated world of investment is a tottering Tower of Jenga, supported ultimately by the presence of gold? Gold has always been the foundation for money, and people have always attempted to expand it, inventing fancy variations and alternatives to it and then abusing and inflating these mutant creations into oblivion along the way. Oh yes - this is not the first time a currency has been destroyed by debasement.

If a massive torrent of displaced wealth is released from the higher levels, where do you think it is going to eventually settle, and what effect do you think this will have on the value of gold? Physical gold carries its own material value: you don't have to trust someone else to make good on your gold, the gold IS the value, so gold is where the buck stops.

I listen to the fag-end "currency reports" on news broadcasts: "The Dollar is up against the Euro, the Euro is down against the Pound" and it conjures up the image of a group of formation sky divers plummeting to earth, holding hands, each one drifting slightly up or down relative to the other, as the ground comes screaming up towards them. No-one is wearing a parachute.

This is why I have encouraged my family and friends to put their savings and investments into physical gold bullion - in my mind, it's not a hedge against price inflation or a punt on a promising commodity with bubble potential: it's protection for their capital against the complete ruin of the existing money system.

If your investments suddenly look flaky, then ask yourself - what would I accept instead, in full settlement, so as to be sure of getting the value I was hoping for? And if, for any reason, the international money system breaks down and is replaced by one or more alternative systems, what do you think will happen to all the existing wealth which is still defined in the old money? And on what basis do you think "New Money" value will be defined from the beginning? Dollars? Pounds?

Wake up and buy gold, my friend - then you can sleep soundly at nights.