The Bigger Picture

In a Nutshell...

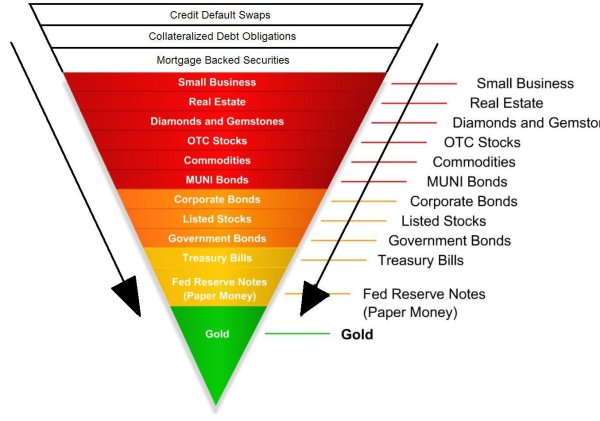

All the evidence suggests that the world financial system is on the verge of an unprecedented series of cascading debt defaults, which may bankrupt some countries, severely damage the banking system and which could destroy much of the value of paper money. Futile bail-out attempts, where countries are lent even more money to cover the debt repayment and interest charges which are already bankrupting them, merely postpone and increase the size of the final crash. The momentum of the forces driving this collapse is now so great that any form of decisive intervention to restore the previous status quo is no longer possible.

The outcome will effectively be the bankruptcy of the middle classes, those who chose to store their wealth in stocks, shares and other technical assets with counter-party risk. Such a scenario would leave the country extremely vulnerable to social unrest, high social cost in caring for pensioners who find they cannot pay for themselves, and if this should take place in the political vacuum of a hung parliament, may leave the door open for the general public to seek more extreme political solutions.

The Pieces on the Chessboard

"...full force of the economic crisis will hit us next year...the problem will get bigger before things can get better..."

--Angela Merkel, German Chancellor, November 11, 2009

"What this crisis reveals is a broken financial system like no other in my lifetime"

--Paul Volcker, Former Chairman, U.S. Federal Reserve (November 16, 2008)

"This is going to be one of the worst economic downturns since the Great Depression."

--Nobel Laureate Economist Joseph Stiglitz, April 25, 2008"

The international financial crisis is far from over – there is strong and growing evidence that the worst is yet to come. There are so many macroeconomic factors which could each, by themselves, cause major financial problems for large numbers of people. The most worrying thing is that there is nothing stopping these factors acting together, or even from triggering each other:

- A second, giant wave of mortgage rate resets and defaults in 2010-11 which will be even bigger than the sub-prime meltdown of late 2008.

- Sovereign debt default on a wide scale – Greece is perilously close to the edge.

- United States – flight of overseas creditors which may finally bankrupt the government.

- “Moral Hazard” – high-level cronyism and corruption in the bail-out game, and covert intervention in markets to sustain political control.

- Demographic load – retiring “Baby Boomers” share sales cause stock market crash.

- Collapse in the value of the paper currencies: the Euro, the Pound and the Dollar.

- Natural limits to resources, where increasing commodity demand meets decreasing supply – peak oil and others.

The dollar as it is now is a doomed currency. The USA is technically bankrupt already, but for the fact that the Federal Reserve Bank is printing vast quantities of money and buying up huge amounts of government debt. The other most relevant paper currencies to Britain – the Euro and the Pound – are by no means safe from failure and collapse. When this should happen, it will be impossible to predict exactly what the fall-out will be on the solvency of businesses, on their customers and suppliers, cash flows, net worth, ability to pay staff wages or even to continue trading.

Massive current account deficits in America have been financed for decades by overseas creditor nations continuing to buy US government (Treasury) bonds. But now, these countries are starting to sell, leaving the US no choice but to allow their Government debt to be bought up by the Federal Reserve Bank. The Fed has an almost infinite capacity to do this, as it is a private banking cartel owned by some of the world’s super-rich and most private families, and it has a monopoly to print interest-bearing paper money out of thin air.

Since the sub-prime shock of autumn 2008, we have been living in a deflationary environment, because individuals have become more wary: they are borrowing less, saving their money and paying down personal debt wherever they can. However, large financial outfits and US Government Sponsored Enterprises are still living in a world of bailouts and “stimulus packages” as the US Govt continues to act as though it can borrow its way out of trouble.

The banks’ entire profit model requires the supply of money and credit to grow without limit. Contraction, or deflation, is anathema to them, and the Fed has already “printed” an unbelievable quantity of new money, and continues to do so, to overcome this deflationary trend. This unchecked use of the printing press to grow the money supply has happened before, and many central banks such as China, Russia and India are quietly buying gold and silver. China is even urging its citizens to buy silver (Link:

YouTube - China urges citizens to buy gold and silver); perversely, in USA and UK we are surrounded by adverts urging us to sell our gold for cash.

Inflation is caused by increasing the money supply; either by issuing more currency or allowing more credit for people who want to borrow. The same goods then have more money chasing them, so their prices start to rise.

Rising prices are only a symptom of inflation – they are not the cause. There will soon be so many new dollars in existence that US consumers will be unable to resist spending again. Indeed, it may be the only way for US citizens to snatch some value from their cash; since there are more dollars outside the USA than inside, overseas holders of dollars will be keen to exchange their paper for something more lasting, as US prices keep inexorably rising. This time there is likely to be a period of runaway inflation ending in a violent readjustment of the value of the dollar and all other world currencies.

If the world outside the US reaches a critical point where it decides to stop believing in the value of the US Government’s backing of its dollar, then the dollar’s collapse will be swift, savage and bewildering.

The effect of this financial tsunami will be catastrophic for anyone with personal wealth in cash, shares or bonds – they may well be wiped out. But even before then, the hyperinflationary pressures may easily destroy the cash flows of businesses, as their suppliers and customers simply lose their faith in their old, familiar trading currency and normal commercial activity breaks down.

Pressures and Triggers

“Sub Prime” II : The Collapse of the Middle-Class Mortgage Market

|

| Mortgage Rate Resets peak again in 2011 |

Following the sub-prime mortgage default disaster of 2008-9, there is another wave of adjustable rate mortgage resets on the horizon for 2010-11 coming from a similar quantity of mortgage borrowing which, although packaged as higher quality, does not qualify for the solid “Prime” rating. Many of these loans were exotic packages which did not require any payment at all for a couple of years, the unpaid amounts being rolled up into the principal and the settlement being contingent on the hope that property prices would continue to rise. This may lead to white-collar defaults on a similar scale to that of the sub-prime meltdown.

Acute US Government Debt Crisis

The US Government is not known for parsimony when it comes to spending. Its outgoings are balanced by tax receipts and the monthly auction sales of US Treasury Debt. As recession bites and tax receipts fall off steeply, to remain solvent the US Govt must sell more and more Treasury Debt instruments (mostly short-term bills, some mid-term notes and very few long-term bonds).

Until very recently, overseas customers have remained active in their regular purchase of US Treasury Debt, notably China. However, since December 2009 China has throttled back on its purchasing, leaving a shortfall. An interesting new purchasing channel for this debt has sprung up in the last few months, via the Caribbean and UK Channel Islands, which is magically keeping the books balanced.

It appears that the Fed are now paying banks interest if the banks use their own reserve funds to buy US Treasuries and then place these Treasuries on deposit at the Fed. This type of behaviour could be directly compared to the problem a municipal waste handler encounters when they run out of landfill sites. If Treasuries represent excess waste, the Fed has declared itself the “waste handler of last resort” and opened a vast storehouse for the whole lot, as long as the banks wrap the waste up nicely so it can be warehoused indefinitely.

There is another problem with Treasury debt, which will come to a head in the next year or so. Since most of this debt could not conceivably be repaid when it falls due, the US Govt hopes that most of its customers will roll over their debt, renewing it for an extended term and allowing the government to merely pay the continuing interest as it falls due. Unfortunately, a very large amount of this debt falls due towards the end of 2011, with an even larger pile falling due in 2012. Owing to the increasingly flaky state of US Govt finances, it is unlikely that the debt holders will want to risk their capital any longer by rolling it over.

This will leave the US Government unable to obtain the funds it needs to continue operating. When this occurs, it is impossible to say what would happen next. I doubt it will be pleasant.

Greece threatens “domino run” collapse in Europe

The new strains on the Euro from bankrupt Greece, followed very closely by Spain, Ireland, Italy and Portugal will have wide-reaching effects. To gain entry to the Euro in the late 90s, Greece got Goldman Sachs to buy their Sovereign debt with discounted Euros, so that they suddenly seemed more presentable. Today, a large proportion of Greek people work in Government jobs; a sizeable chunk of the Greek debt to France and Germany is Greek Government debt, not corporate debt, and since Moody’s downgraded Greece’s sovereign debt, teetering Greece suddenly has to pay even more to service its impossible debt. Greece also has a lot of sovereign investment in East European countries, all of whom could be severely starved of money if Greece defaults.

Bail-out cronyism: Banking Cabal emerges

More bailout money will be spent in UK and USA to prop up ailing financial houses. This money will all be borrowed from central banks and be nominally repayable out of future tax revenue; in reality, it will be paid for now by all of us as the buying power of our currency is diluted by the newly-issued money. The financial organisations involved have a closed circle of self-interest, just over the AIG bail-out, more details emerge daily:

UK Bailout Stories

US Bailout Stories

US gearing up for serious inflation

|

| US Monetary Base |

In 2008 the amount of dollars circulating as coins and notes in the US was about $850billion: this had grown steadily since 1913, when the Federal Reserve came into being. However, last year, owing to government debt management tactics, the money supply has been DOUBLED to $1700billion. This money is all borrowed from the Federal Reserve (at interest), and is notionally repayable to the Fed out of tax dollars – however, the Fed doesn’t want it back, as the principal sum it represents cost them nothing to issue: the interest is the only real money in this game.

Because there are suddenly a lot more dollars, as they seep into normal circulation their buying power will fall. The US economy will start to see accelerating inflation, which will get worse as the Fed prints even more “funny money”. This inflation will affect all trading partners of the US, who will see inflationary pressures on their own economies.

US Government over-reliant on dwindling Overseas Savers

The Chinese government is formally “a little bit worried” that the $800billion which Chinese banks have invested in US Treasury Bills (T-Bills) is no longer safe money. When China trades with the US and gets paid in dollars, they don’t want to exchange these dollars for their own currency (the Yuan). If they did that, the increased demand for Yuan on the foreign exchanges would increase its value, making their goods more expensive to Americans and so China would become less competitive. To avoid this, they buy dollar-denominated T-Bills: then there is no currency exchange, and until recently, China has acted as though this investment was safe. China has until recently been the No.1 overseas creditor to the US. Now, they have reduced their holdings of T-Bills, and have just moved into second place behind Japan, which also holds about $800bn of T-Bills. T-Bills are US Government debt, which the US needs to sell to balance their books. Once overseas creditors start moving out of T-Bills, America’s government effectively becomes bankrupt. Only the Federal Reserve can buy the unwanted government debt, and this will lead to accelerated inflation and reduce the value of the dollar.

US Dollar will cease being the International Reserve Currency

China will continue to push to depose the dollar as the international reserve currency.

So will the United Nations.

So will the Saudis.

Retiring Baby Boomers will hammer the Stock Markets

A substantial demographic demand for shares came from the US Baby Boomers, who filled their Individual Retirement Accounts (IRAs) with shares through the 1990s and early 2000s while credit was easy. As they bought, the market boomed. In the next year or two, whatever else happens, the US market will be faced with a sudden supply of shares for sale, as IRA holders are obliged to start selling pension assets to generate a minimum level of income once they are aged 70½. This will boost the supply of shares and drive their prices downwards. Other investors, seeing the fall in share prices, will also sell, driving prices lower still.

US End Game: Dollar Devaluation and expanded Political Union

People will squirrel their cash away as savings, fearful for the future. Bad debts will fold, and long-term debts will be settled early. All these things will reduce the money supply in the economy and cause deflation, the Federal Reserve’s No.1 fear. To compensate, the Fed will switch on the dollar printing presses in a vain attempt to revive markets with more available currency. This can only lead to runaway inflation, as there is no incentive for the Fed to switch off the printing press.

This will destroy any remaining value in the dollar. There will suddenly come a point when they announce that they can no longer service the National Debt. They will quietly announce default and there will be a massive, desperate international fire-sale of dollar-based assets by those who didn’t see it coming.

It is entirely likely that the US Government will devalue the dollar and issue a new currency. This will reduce Federal/international debt to a much more manageable level, but will wipe out ordinary savers and anyone who has wealth which was previously measured in “old” dollars. Now that Europe has a unified EU political trading block, the US may also use this “shock” to drive ahead with controversial plans for an enlarged trade block (Mexico, USA & Canada) – The Union of North America – against the wishes of Canada.

Natural Limits to Global Expansion

Apart from all this financial chicanery, there is the abiding and inevitable problem of finite economic, energy and environmental resources which will impose limits to growth – maybe quite suddenly. Chris Martenson’s “Crash Course” is an excellent précis on the subject:

Here is a sobering and rather uncomfortable article written by Dmitri Orlov, a Russia commentator who lived through the break-up of the old USSR. He warns that the US could face a similar collapse, for which they are woefully unprepared.